Federal marginal income tax rates 2021

MARRIED FILING JOINTLY OR QUALIFYING WIDOW. The federal income tax rates remain unchanged for the 2021 and 2022 tax years.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Use the time slider beneath the chart to see data from different 5-year period.

. What is the federal tax bracket for 2021 in Canada. Your 2021 Tax Bracket To See Whats Been Adjusted. Income and Salaries for Fawn Creek - The average.

Ad Compare Your 2022 Tax Bracket vs. 0 would also be your average tax rate. Census Bureaus American Community Survey ACS 5-year estimates Table B27015.

Your Federal taxes are estimated at 0. Calculating Income Tax Liability For many individuals and families calculating federal income tax liability can be broken down into three. 2021 Tax Brackets by Filing Status.

Updated with tax rates for tax year 2020 due April 2021 Single Married Jointly. Ad Access IRS Tax Forms. - The Income Tax Rate for Fawn Creek is 57.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of. This is 0 of your total income of 0. Complete Edit or Print Tax Forms Instantly.

HEAD OF HOUSEHOLD TAX BRACKETS. The top marginal income tax rate. Federal Tax Bracket Rates 2021.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Here are charts of federal income tax brackets or marginal tax rates per the United States tax code for the tax years 2022 2021 2020 2019 2018 and 2017. Data is from the US.

See If You Qualify and File Today. Discover Helpful Information And Resources On Taxes From AARP. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal.

The chart below compares the median income of veteran population with that of nonveteran population. 2021 - 2022 Income Tax. However some of your income will be taxed at the lower tax brackets 10 and.

For 2018 and previous tax years you can find the federal. The table below shows the tax brackets for the federal. 2021 Federal Income Tax Rates - Tax Year 2020.

LiveStories calculated the percentages. The federal income tax consists of six marginal tax. - Tax Rates can have a big impact when Comparing Cost of Living.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. Federal Individual Income Tax Rates and Brackets. The United States federal tax laws follow a progressive tax system with 2019-2020 marginal tax rates varying from 10 to 37.

The data only includes the. Ad File For Free With TurboTax Free Edition. To find income tax rates for previous years see the Income Tax Package for that year.

In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer. Ordinary income dividends interest and short-term capital. Tax rates for previous years 1985 to 2021.

The US average is 46. SINGLE FILERS TAX BRACKETS. How Do Marginal Income Tax Rates Work in 2021.

Your income puts you in the 10 tax bracket. At higher incomes many. If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Understanding Marginal Income Tax Brackets Silver Penny Financial

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Federal Income Tax Bracket What Tax Bracket Am I In Br

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Personal Income Tax Brackets Ontario 2021 Md Tax

2020 Federal Income Tax Brackets

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2018 Irs Federal Income Tax Brackets Breakdown Example Married W 1 Child My Money Blog

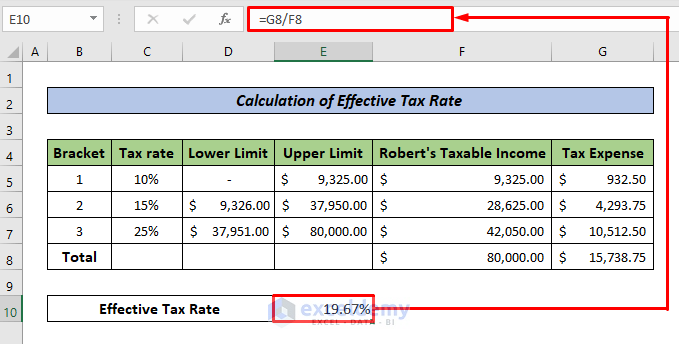

How To Calculate Federal Tax Rate In Excel With Easy Steps